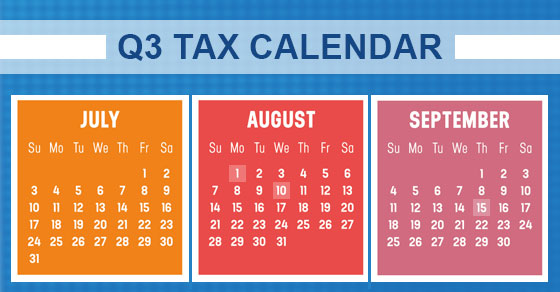

2024 Q2 tax calendar: Key deadlines for businesses and employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing […]

2024 Q2 tax calendar: Key deadlines for businesses and employers Read More »