What are the tax implications of winning money or valuable prizes?

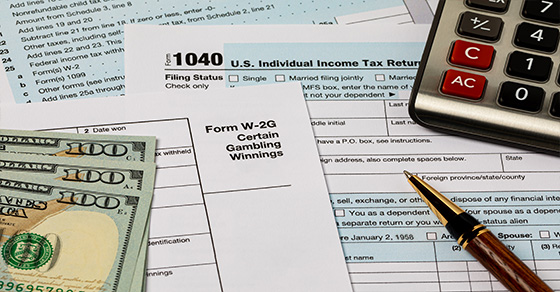

If you gamble or buy lottery tickets and you’re lucky enough to win, congratulations! After you celebrate, be aware that there are tax consequences attached to your good fortune. Winning at gambling. For tax purposes, it doesn’t matter if you win at the casino, a bingo hall or elsewhere. You must report 100% of your […]

What are the tax implications of winning money or valuable prizes? Read More »